Utilizing automated AR software program can make it simpler to bill your clients and ensure they pay on time. Clean and detailed invoices are extra manageable for your clients to read https://www.simple-accounting.org/ and perceive. Creating and sticking to a billing schedule makes it easier on your company to collect receivables quicker.

Accounts Receivable Turnover Ration Calculator

The accounts receivable turnover ratio is an accounting measure used to quantify an organization’s effectiveness in amassing its receivables or money owed by clients. The ratio exhibits how properly a company uses and manages the credit it extends to prospects and the way rapidly that short-term debt is collected or is paid. The receivables turnover ratio is also called the accounts receivable turnover ratio. The accounts payable turnover ratio evaluates how well a company manages payments to distributors.

In contrast, a high ratio in a slow-turnover sector (e.g., actual estate) could counsel aggressive collection strategies. Firms can significantly scale back collection delays and enhance their cash flow using Tally ERP. Upgrading to a paid membership offers you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Packages.

Industry Benchmarks For Accounts Receivable Turnover Ratio

- While accounts receivable turnover ratio supplies an effective way to quickly measure your assortment effectivity, it has its limitations.

- For instance, in case your average collection period is 41 days however your payment terms are internet 30 days, you can see clients have a tendency to pay late.

- A larger inventory ratio is often higher, though there can also be downsides to a high turnover.

- Opponents corresponding to H&M and Zara sometimes limit runs and substitute depleted stock rapidly with new items.

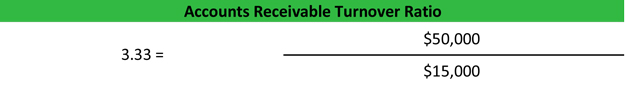

To do this, use an accounts receivable turnover formula that takes the quantity you had in AR at the beginning of the accounting interval and add it to the amount you had in AR on the finish of that interval. Assortment challenges are often a result of inefficiencies within the accounts receivable (AR) process. Accounts receivable turnover ratio is an important metric for determining the effectiveness of your collection efforts to have the ability to make any essential course corrections. New clients who don’t have a fee historical past with your business could turn out to be slow-paying clients. Assessing prospects earlier than providing cost phrases can also be time-consuming.A firm’s credit coverage, nonetheless, can create tradeoffs. If your corporation has a conservative credit score policy and doesn’t supply credit score terms to consumers, you’ll lose some potential sales.

For example, if the corporate’s distribution division is operating poorly, it may be failing to ship the right goods to customers in a timely method. As a outcome, clients might delay paying their receivable, which might decrease the company’s receivables turnover ratio. The asset turnover ratio measures the worth of an organization’s gross sales or revenues relative to the value of its belongings. The asset turnover ratio is an indicator of the effectivity with which a company is utilizing its belongings to generate revenue. Conversely, if a company has a low asset turnover ratio, it indicates it isn’t effectively utilizing its belongings to generate gross sales.

As such, the start and ending values chosen when calculating the common accounts receivable must be rigorously chosen so to accurately replicate the company’s efficiency. Buyers may take an average of accounts receivable from each month during a 12-month interval to assist smooth out any seasonal gaps. A firm may improve its turnover ratio by making modifications to its collection course of. It Is essential for firms to know their receivables turnover since its instantly tied to how a lot money they will out there to pay their short term liabilities.

Due to the time value of money principle, the longer an organization takes to gather on its credit gross sales, the extra money an organization successfully loses, or the much less useful are the company’s gross sales. Due To This Fact, a low or declining accounts receivable turnover ratio is taken into account detrimental to a company. To calculate your accounts receivable turnover, you’ll want to determine your net credit score sales.

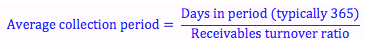

Due To This Fact, the typical buyer takes approximately 51 days to pay their debt to the shop. If Trinity Bikes Store maintains a coverage for funds made on credit, such as a 30-day coverage, the receivable turnover in days calculated above would point out that the typical buyer makes late funds. The receivables turnover ratio can help an organization understand its present money circulate pattern. The higher the ratio, the more environment friendly the company is at collecting excellent account balances. The decrease the ratio, the more inefficient they might be—meaning the corporate converts its accounts receivable to money less usually. To calculate the ratio, you’ll must know the steadiness of your common accounts receivable.

Dividing the one year within the year by eight.eight reveals that Walmart turned over its inventory about each 41 days on average. The stock turnover ratio could be one way of higher understanding dead stock. In theory, if a company is not selling a lot of a selected product, the COGS of that good will be very low (since COGS is just acknowledged upon a sale). Therefore, products with a low turnover ratio ought to be evaluated periodically to see if the inventory is obsolete. To perceive what your AR turnover ratio means, you should at all times compare it to what’s thought of normal in your business. Industries like manufacturing and building sometimes have longer credit cycles (e.g., 90-day terms), which makes decrease AR turnover ratios normal for companies in those sectors.

The receivable turnover ratio is also useful for assessing the efficacy of a company’s credit department and money inflow. Via the analysis of tendencies in this ratio, it’s possible to determine areas for development so as to improve money inflows and fortify working capital by means of more meticulous receivables administration. As you’ll be able to see above, what determines a “good” accounts receivable turnover ratio is decided by numerous factors. Holding the reins too tightly can have a unfavorable impact on business, whereas being too lackadaisical about collections results in limited cash move. By accepting insurance coverage payments and money payments from patients, a neighborhood doctor’s workplace has a mixture of credit and money sales. The accounts receivable turnover price is 10, which suggests the average accounts receivable is collected in 36.5 days (365 days divided by 10).